Elliott Seeks Compensation From South Korea Over Samsung Fight

Elliott Management Corp. is seeking compensation from South Korea over how its former administration intervened in the merger of Samsung C&T Corp. and Cheil Industries Inc. in 2015, a deal that led to a massive corruption scandal in the country.

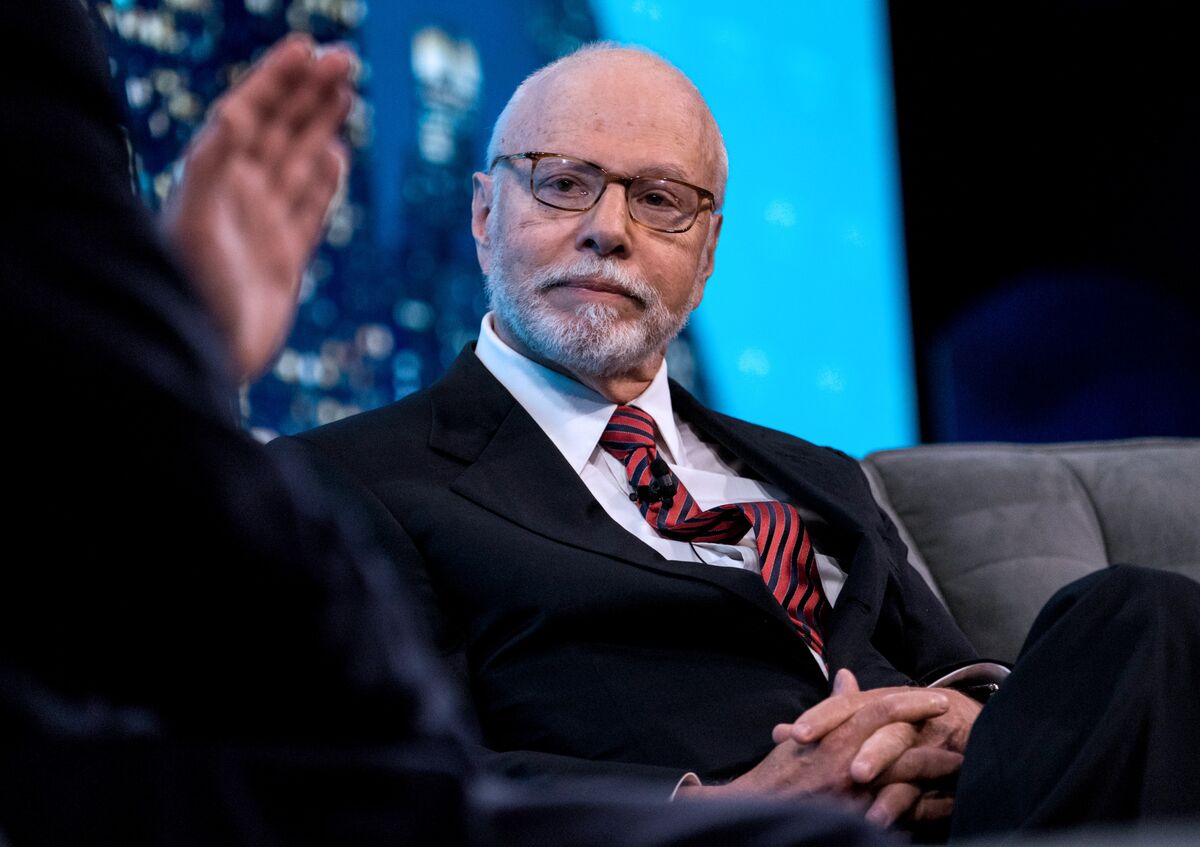

Billionaire Paul Singer’s New York-based hedge fund lost a proxy fight to oppose the combination of the Samsung units, solidifying the founding family’s grip over the group. Samsung narrowly won the vote, clinching support from the government-run National Pension Service.

NPS sided with Samsung after pressure from the presidential office, landing the minister that was then in charge of the pension fund in jail. Elliott, which owned about 7 percent of Samsung C&T at the time, says it incurred significant damages as a result of the former administration’s hand in allowing the merger to go through.

“The facts revealed since the 2015 merger are clear: the web of corruption reaching from the president herself down to the NPS, unfairly damaged Elliott and other Samsung C&T shareholders,” Elliott said in a statement Tuesday. Elliott said it wants to negotiate with the Republic of Korea regarding compensation.

Samsung Vice Chairman Jay Y. Lee, who’s been leading the group after his father slipped into a coma, walked free from prison last month after his sentence for bribery in connection to the deal was suspended.

Also last month, Park Geun-hye, South Korea’s first female president, was sentenced to 24 years in prison after being found guilty on charges including bribery and abuse of power. Citing a lack of evidence, the judges rejected prosecutors’ allegations that Park sought bribes from Samsung in return for government help to solidify Lee’s control of the conglomerate.

Elliott said Tuesday the actions of the former administration were in breach of the U.S.-Korea free trade agreement and “constituted manifestly unfair and inequitable treatment of Elliott.” It didn’t disclose how much it would seek in damages.

Singer sent a notice of intent on April 13 to South Korea’s Justice Ministry to ask for resolution over its objections regarding the merger, a government official said. If the two sides fail to resolve the issue within three months of a notice, a U.S. investor can initiate an investor-state dispute against South Korea under Korea-U.S. free trade agreement, the official said.

Elliott last month launched another fight in South Korea, targeting Hyundai Motor Group. The firm is pushing for Hyundai to adopt a more efficient holding company structure, announce actionable targets for balance sheet optimization, improve shareholder returns and implement board structures that ensure best-in-class governance.

— With assistance by Kanga Kong, and Yoojung Lee

Post a Comment