Worldwide smartphone shipments slip for first time ever: Apple and Samsung hit

Chinese phone giants grow, the big 5 are out in cold

The global smartphone market is shrinking for the first time as choosey buyers in emerging markets hang on to their mobiles for longer.

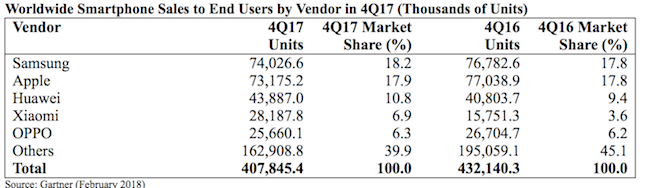

In Gartner’s Q4 sales stats, Samsung maintained a narrow lead in global volume shipments of smartphones – but every major (top five) vendor outside of those based in China saw unit shipments slip.

Some 407.84 million handsets found a new home in the quarter, equating to a 5.6 per cent slide or 24.29 million fewer phones sold than the prior year.

Several major factors caused the market shrinkage, said Anshul Gupta, research director at Gartner. “First, upgrades from feature phones to smartphones have slowed right down due to a lack of quality ‘ultra-low-cost’ smartphones and users preferring to buy quality feature phones.

“Second, replacement smartphone users are choosing quality models and keeping them longer, lengthening the replacement cycle of smartphones. Moreover, while demand for high quality, 4G connectivity and better camera features remained strong, high expectations and few incremental benefits during replacement weakened smartphone sales,” Gupta added.

This is a characteristic of the emerging markets, where all the action is – not mature markets like the UK or USA.

Samsung leap-frogged Apple by virtue of its sales declining slower than the market average - Sammy’s numbers were 3.6 per cent to 74.02 million units.

Gartner pointed out Samsung is poised to lift the covers off its flagship mobe, though "significant sales" volumes are generated by customers buying entry-level and mid-priced hardware.

Apple dropped 5 per cent in the quarter to 73.17 million and the company should make up sales in the current quarter, said Gupta. "We expect good demand for the iPhone X to likely bring a delayed sales boost for Apple in the first quarter of 2018.”

The story was different for Chinese giants Huawei and Xiaomi, which reported sales leaps of 7.6 and 7.9 per cent respectively to 43.8 million and 28.18 million. Huawei added the Mate 10 Lite, Honor 6C Pro and Enjoy 7S, broadening its portfolio to appeal to different types of buyers. Oppo went backwards in Q4 as sales slipped to 25.66 million from 26.7 million.

“Future growth opportunities for Huawei will reside in winning market share in emerging APAC and the US,” said Gupta, “Xiaomi’s biggest market outside China is India, where it will continue to see high growth. Increasing sales in Indonesia and other markets in emerging APAC will position Xiaomi as a strong global brand.”

For all of 2017, Samsung led the global sales stakes with 321.26 million devices shipped, followed by Apple with 214.92 million, Huawei with 150.5 million, Oppo with 112.12 million and Vivo with 99.6 million.

With respect to operating systems, Android tightened its stranglehold on the sector with market share of 85.9 per cent, up from 84.8 per cent in 2016. iOS shrank to 14 per cent from 14.4 per dent and "other OSes" including Windows held 0.1 per cent of smartmobe sales, down from 0.8 per cent. ®

Sponsored: Minds Mastering Machines - Call for papers now open

Post a Comment